|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

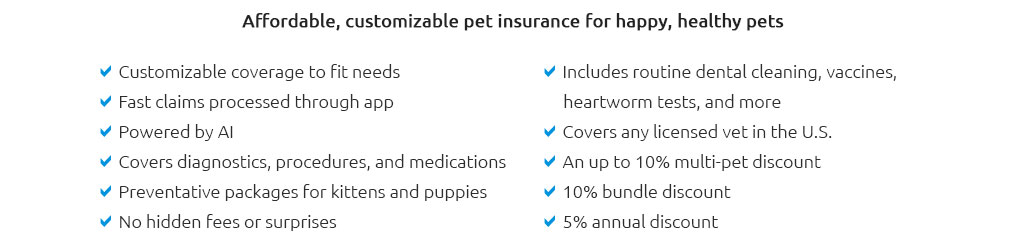

pet insurance costs for dogs: data-backed insights that keep surprises smallI've reviewed pricing filings, sample policies, and claim studies to understand how premiums translate into real outcomes. The goal isn't to hype or dismiss insurance - it's to clarify what you're buying: volatility control for canine healthcare spending. What people actually payAcross U.S. markets, accident + illness coverage for dogs commonly lands in the $30 - $90 per month range for young, mixed-breed, mid-size dogs with moderate coverage. Accident-only can be lower, often $10 - $25. Large breeds, purebreds with known risks, and older dogs often see $70 - $150+. Geography matters; so do plan levers like deductibles and limits. Why the range is wide

Plan levers and their price impactThree dials drive most of the premium difference - and your eventual out-of-pocket.

I almost framed this as "find the cheapest premium." Minor backtrack: the accurate target is the best lifetime cash-flow profile given your dog's risk and your savings buffer. A real moment from the fieldDenver, 4-year-old Labrador. Weekend limp becomes a torn cruciate ligament; estimate: $4,200 surgery. The owner's policy: $500 annual deductible, 80% reimbursement, $10,000 limit, $55/month premium. After deductible, insurer covers 80% of the remaining $3,700 - except wait, refine: the deductible applies first, leaving $3,500 at 80%. Owner pays $500 + $700 = $1,200 for the medical bill, plus premiums. Not a magic wand, but it turned a frightening number into something budget-manageable. The relief was palpable at checkout. Short math: premiums into outcomesTo compare options, translate monthly cost into scenarios. Same sample plan: $55/mo premium, $500 annual deductible, 80% reimbursement, $10k limit.

Lifetime view and inflationVeterinary inflation runs ahead of general CPI in many regions. As dogs age, claim severity often increases, and premiums tend to rise. Outcome focus: choose a structure you can keep for 8 - 12 years. Frequent switching risks new waiting periods and exclusions for anything noted in records. How to benchmark a quote in 5 minutes

Trust cues and fine print that matter

Bottom linePet insurance is a volatility tool, not a guarantee of saving money every year. If a single $4,000 - $8,000 event would strain your budget, a well-chosen policy converts that risk into a steady, known payment and a capped downside. If you can comfortably self-insure large shocks, a higher deductible - or no policy - may be rational. Either way, optimize for long-term stability: coverage you can keep, terms you understand, and outcomes that stay within your comfort zone.

|